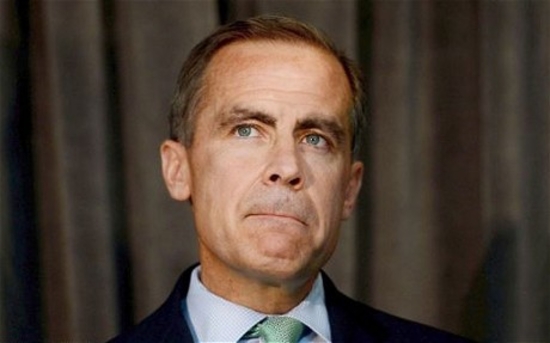

Mark Carney, the Governor of the Bank of England, has warned senior bankers that conduct costs related to past misbehaviour have become the most pressing issue for the industry

By Harry Wilson, Banking Editor, The Telegraph online

Mark Carney, the Governor of the Bank of England, has told a group of senior bankers that dealing with the legacy of past wrongdoing is becoming the most pressing issue for the industry.

Mr Carney is understood to have discussed the growing problem of conduct risks with Douglas Flint, chairman of HSBC, Peter Sands, chief executive of Standard Chartered, and Deutsche co-chief executive Anshu Jain, in a private session at the World Economic Forum.

It followed a lunch at the Davos event at which the Governor warned that financial institutions must not see fines for misconduct as “a cost of doing business” and said only “exemplary behaviour” would restore trust in the industry.

“While regulators will fix the mechanics of benchmarks in markets ranging from Libor to FX [foreign exchange], only private individuals and institutions can reform the behaviour that has made such changes necessary,” said Mr Carney at the lunch hosted by the CBI.

“Changes to the structure of compensation will better align the incentives of bank staff and their shareholders, but not every risk can be anticipated,” he added.